This is how many furloughed Main Street employees will get jobs back

After weeks of ominous news, March 26 was the day the coronavirus outbreak cemented itself as an economic catastrophe in the U.S. On that day, the Department of Labor released its weekly estimate of initial unemployment insurance claims, one official measure the government uses to determine how many people are out of work across the country.

The previous week, 282,000 people had filed for unemployment insurance. In the history of the data series, going back to 1967, no single week had reached the mark of 700,000 people filing for unemployment. On March 26, 3.3 million people reported having lost their jobs in the seven days prior.

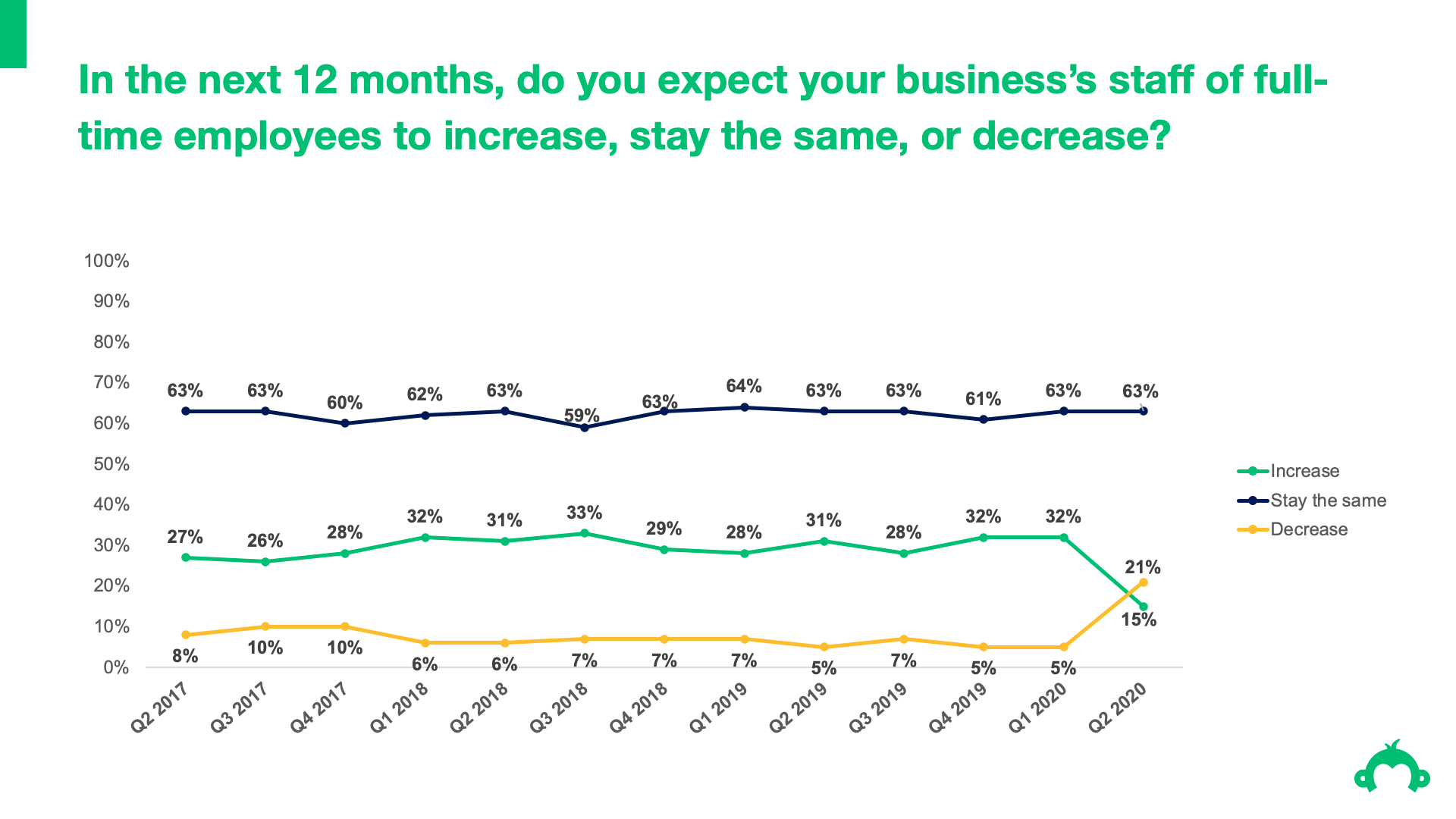

Small businesses didn’t see it coming, but it came quick. In the latest CNBC|SurveyMonkey Small Business Survey, conducted April 21–27 among 2,200 entrepreneurs across the country, almost a third of (32%) say their headcount has decreased in the past two months, six times higher than the 5% who in Q1 said they expected their staff of full-time employees to decrease over the subsequent 12 months.

Nearly a quarter (22%) of small business owners say they’ve had to lay off or furlough some or all of their employees as a direct result of the coronavirus outbreak. This includes 8% who have begun layoffs, 11% who’ve furloughed workers, and another 3% who have done both.

The plummet in hiring expectations — along with the concurrent drops in revenue expectations, business environment, and policy changes looking ahead — led to the sharpest decline in small business sentiment in the three-year history of the survey. Main Street will have to wait out the pandemic before hiring again.

Will you get your job back?

Here’s the good news: though no one knows how long this crisis will last, small business owners say the jobs will be there again when it is over.

Nearly all of the small business owners who have had to lay off or furlough employees intend to hire again once things return to normal. Just over half (52%) expect to hire everyone back who has been let go, and 37% expect to hire some back. Fewer than one in 10 (9%) say they don’t expect to re-hire anyone who has been furloughed or laid off.

The Paycheck Protection Program was one measure introduced by Congress with the explicit intent of limiting the economic fallout from the coronavirus outbreak by protecting jobs. Under this program, businesses are incentivized to keep workers on the payroll in order to essentially freeze the economy in place — to buy time for as many people as possible to stay at home under social distancing protocols.

People who lost their jobs wait in line to file for unemployment following an outbreak of the coronavirus disease (COVID-19), at an Arkansas Workforce Center in Fort Smith, Arkansas, U.S. April 6, 2020.

Nick Oxford | File Photo | REUTERS

The dramatic burst of unemployment claims that began in late March proves that the PPP and other government assistance wasn’t enough to keep an unprecedented number of workers from losing their jobs. As the unemployment charts demonstrate, the PPP money may have come too late to have been fully effective.

In our survey, small business owners who have applied for PPP loans are actually much more likely than those who have not applied to say they have furloughed or laid off employees as a result of the coronavirus crisis (37% vs. 11%). Most of those who have applied are still waiting to hear whether they were accepted.

But the PPP still has some bright spots in the small business environment. Of those who have applied for a PPP loan and who have had to make headcount cuts, 57% expect to hire all and 36% expect to hire some of their workers back. Among those who have not applied, 48% expect to hire back all and 37% expect to hire back some of their lost workers.

Upended expectations make hiring forecasts difficult

Extrapolating previous results forward is a notoriously bad way to make predictions, but the coronavirus-induced plummet in demand that small business owners experienced from March into April was truly a shock, particularly as it related to hiring expectations. Just a few months ago, our CNBC|SurveyMonkey Small Business Survey covered the extreme measures small businesses were taking to add workers in a tight economy: upping their salary offers, adding benefits, and creating more flexible work policies.

In fact, in the 12 previous quarters of the survey, at most 10% of small business owners had said they expected their staff of full-time employees to decrease — and that number hadn’t been that high since the third quarter of 2017. Since then, it has hovered in the single digits.

Things are of course different now, which makes the future harder to predict. This quarter, 21% of small business owners say they expect their staff size to decrease in the next year, while 15% expect it to increase (down from 32%). That means that more small business owners now expect the number of full-time employees to decrease in the next year than expect it to increase — the first time that has been reported in the three years of this survey.

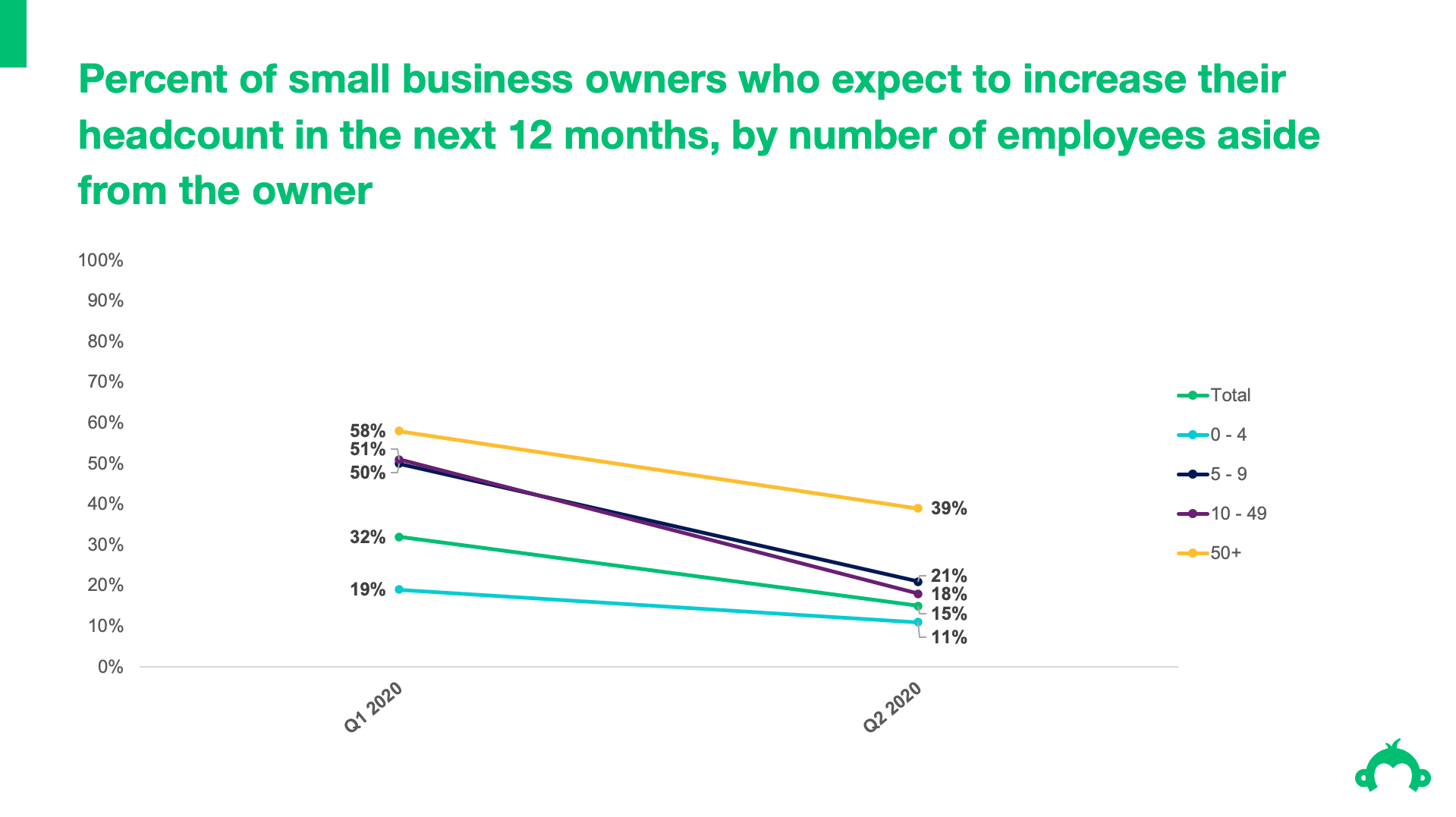

Cutting the data by demographics and business characteristics reveals no secret success story waiting to emerge in this crisis.

No single region, sector, or industry is better positioned to get back to normal when the national economy is in a total shutdown. Though by definition some small businesses have always been very small — most, in fact, have fewer than five employees aside from the owner — small businesses of all sizes reported about the same percentage decrease in hiring expectations from the first quarter to now.

Just as small business owners couldn’t foresee the coming economy-wide shocks in Q1, they can’t be relied upon to know how their business’s hiring will change in the coming weeks and months. Small business owners’ intentions are to hire back their lost workers when we all get back to normal. A lot can change in the meantime.

Print the article

Print the article